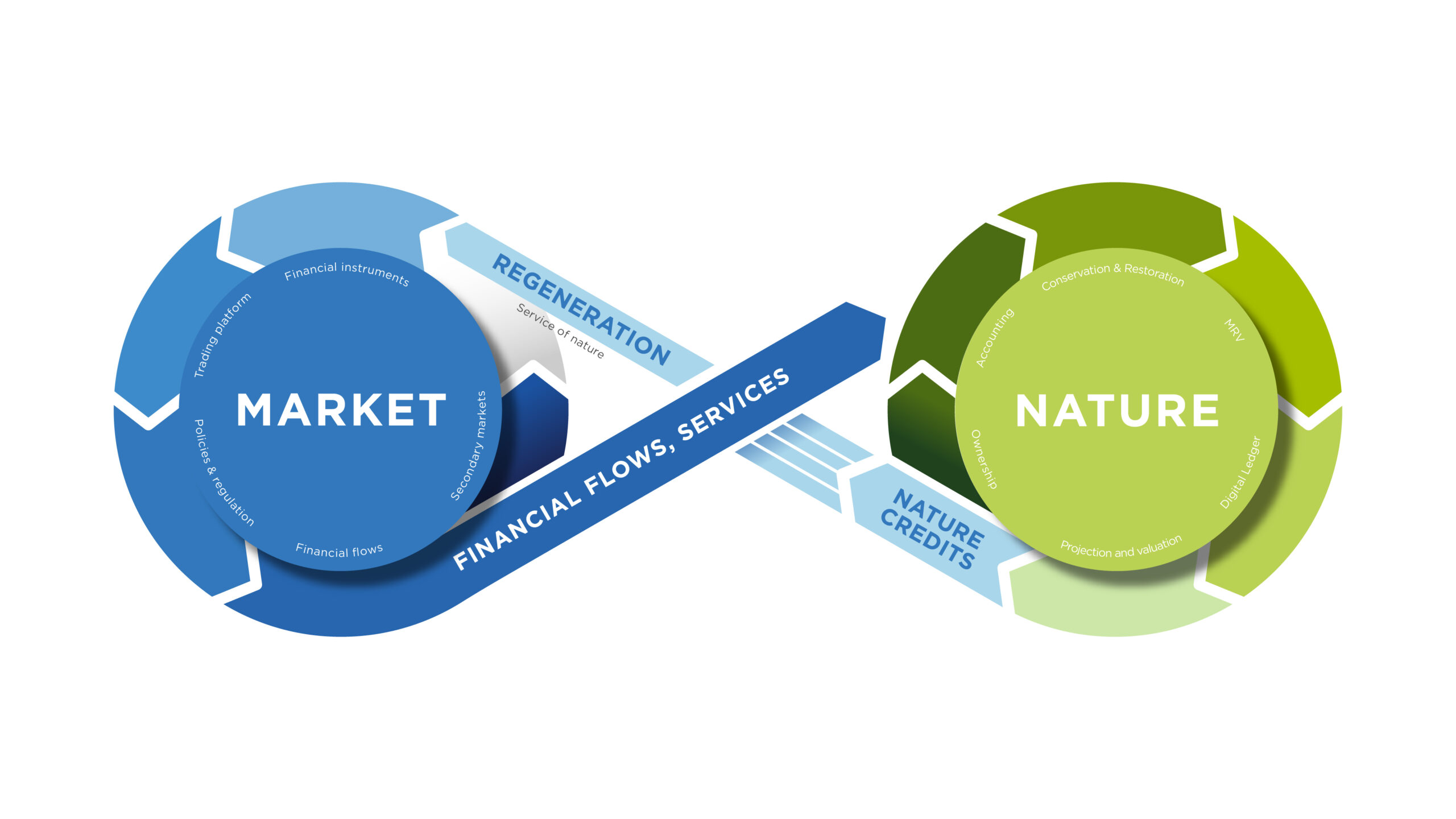

Our novel living nature market investment structure enables investors to finance these projects in their infancy. Investors then capitalise on the future value of the carbon, nature and biodiversity credits.

Nature wealth funds are established to ensure the long-term flow of funding to nature and stewards of nature

We bridge the gap by;

Firstly, asset ownership must be defined.

A critical feature of the Blue Green Model is that the underlying land is never sold. Rather, the eco-system services provided on land and in the ocean are valued and then invested in. Clear legal ownership of the natural asset is essential. Without it, markets can’t function. Before any project begins, legal ownership of the land is verified and / or codified into law.

The assets’ health and potential are then assessed.

Ecologists and climate scientists study the asset’s health, physiology, and historical extent. They identify risks and restoration potential, and then set a scientific baseline for growth and projections for carbon sequestration.

Then the project can begin.

Project developers define carbon methodologies, protection and restoration plans, and long-term interventions aligned with best-available science.