Our economic system is flawed. We have been using nature like a never-ending free resource. Markets have viewed nature only in terms of how much can be killed, cut, mined, harvested, fished and sold, while living nature is invisible and has no price.

But science now shows us how living nature is also incredibly valuable. It provides services integral to our own well-being and underpins our economy. It provides clean air, filtered water, shade, rain, soil, carbon sequestration, pollination, flood control, habitats for biodiversity, and more.

By translating some of these ecosystem services into monetary values – they become visible and investable assets, which increase in value if protected and allowed to grow.

We're here to make living nature visible, valued, and to bring investment into these living systems such that communities and indigenous people benefit, and nature flourishes once again.

This great opportunity lies ahead.

Conservation and restoration of natural capital is one of the biggest investment opportunities of our lifetime — and the most urgent. Yet trillions of dollars sit on the sidelines, unsure how and when to jump into this new market. Many natural asset projects remain underfunded or not funded at all.

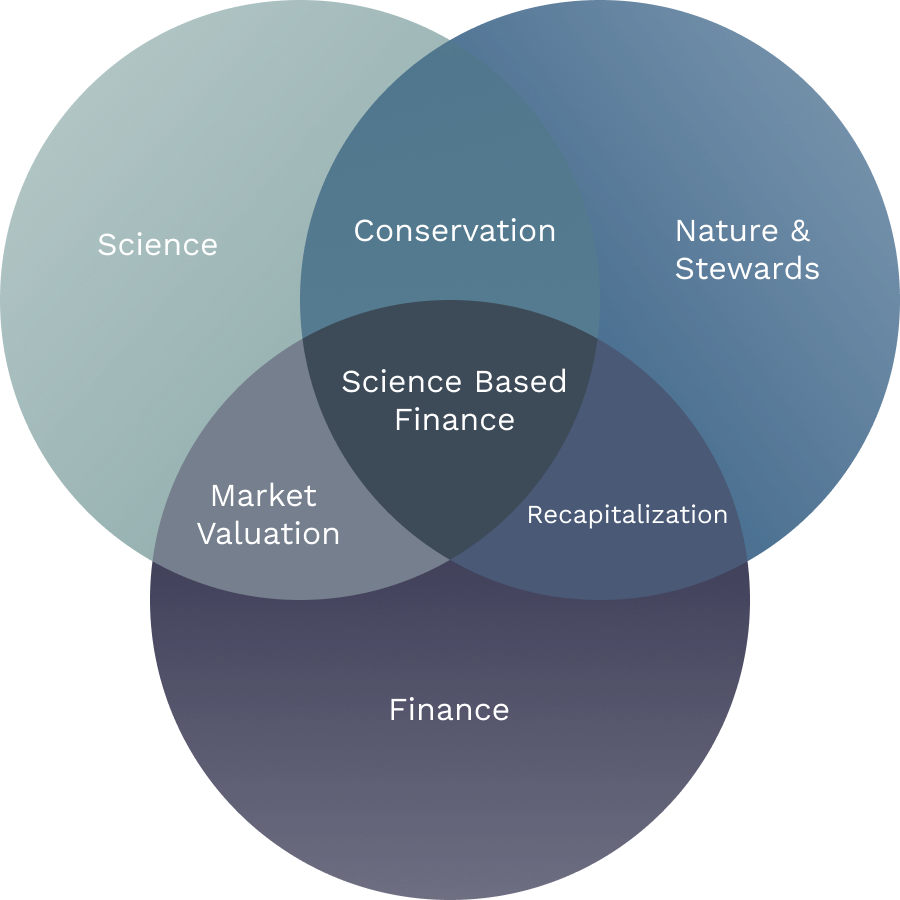

Science-Based Finance allows asset owners to understand what their natural assets are worth in terms of the value of the services, and supports decision making for owners of natural assets as well as investors, demystifying this new market.